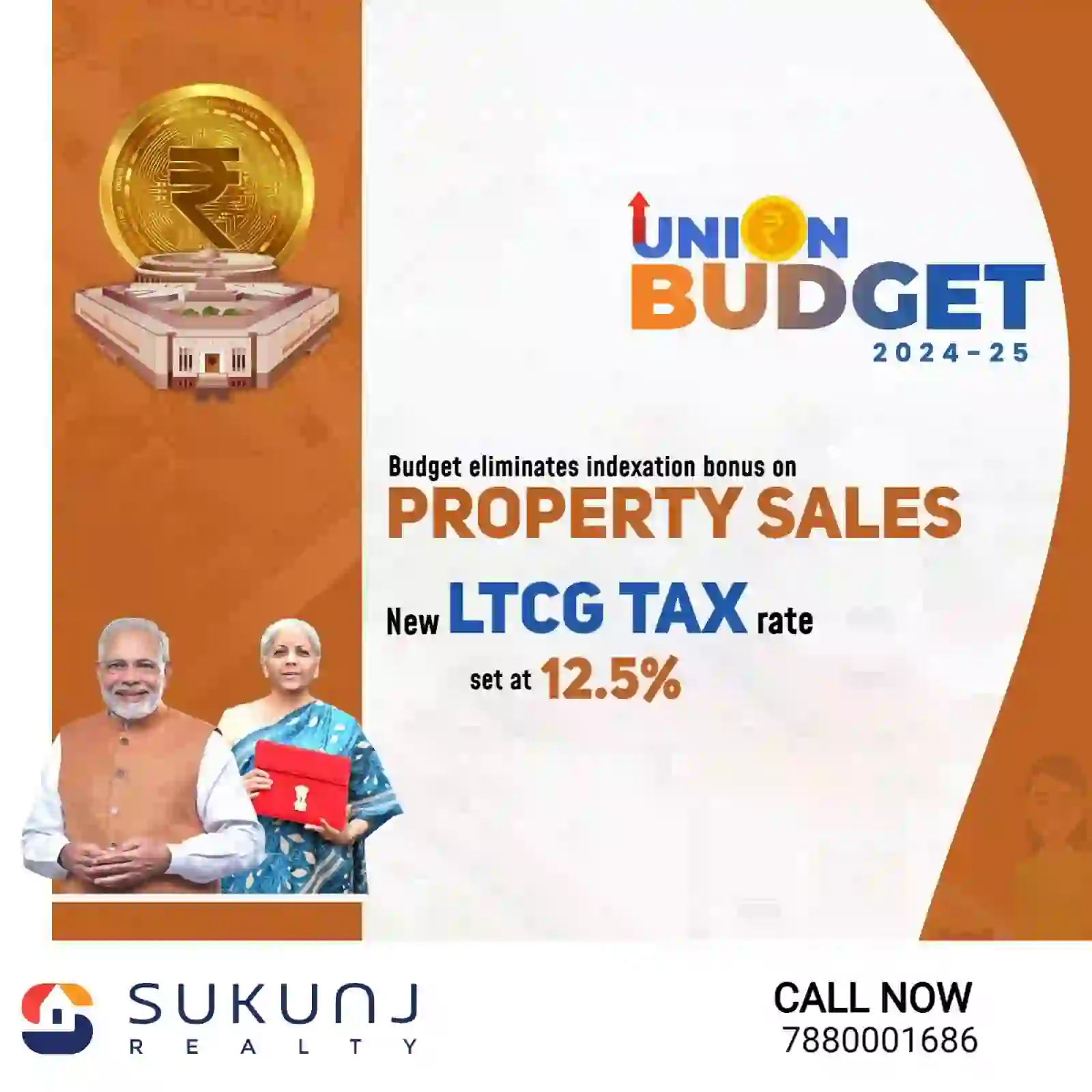

The 2024 Union Budget has introduced significant changes, particularly for real estate investors. With the introduction of a new long-term capital gains (LTCG) tax rate and the removal of the indexation benefit, the landscape for property investment has been notably altered. This blog explores whether these changes are beneficial or detrimental to real estate investors and what the overall implications might be.

Understanding the 2024 Budget Changes

What is the New LTCG Tax Rate?

The budget has reduced the LTCG tax rate from 20% to 12.5%. This reduction aims to streamline the tax regime and potentially increase liquidity in property transactions. However, this change is paired with the removal of the indexation benefit, which previously allowed investors to adjust the purchase price of a property for inflation, thereby reducing taxable gains.

Why Was the Indexation Benefit Removed?

The indexation benefit was a crucial tool for real estate investors, helping to mitigate the effects of inflation on long-term investments. By removing this benefit, the government aims to simplify the tax system, making it easier to calculate taxes. However, this also means that investors may face a higher tax burden as the purchase price of properties will not be adjusted for inflation.

Impact on Real Estate Transactions

How Do These Changes Affect Property Sales?

For those holding properties for a long time, the removal of indexation could result in higher taxable gains, even though the tax rate is lower. For example, if an investor bought a property for Rs 25 lakh in 2002-03 and sold it for Rs 1 crore in 2023-24, under the previous regime, the adjusted purchase price could have been higher, thus reducing the taxable gain. Under the new rules, the gain is simply the sale price minus the purchase price, taxed at 12.5%.

What Are the Market Reactions?

The market’s response to these changes has been mixed. While the reduction in the LTCG rate is seen as a positive move, the elimination of indexation has raised concerns among long-term investors. Some see the changes as a way to bring more uniformity and simplicity to the tax system, while others worry about the increased tax burden.

Government’s Rationale and Broader Impact

Why Did the Government Make These Changes?

According to the Finance Minister, the removal of the indexation benefit and the reduction in the LTCG tax rate are part of a broader effort to simplify the tax system and make it more transparent. The changes are also intended to encourage more liquidity in the real estate market, which has been sluggish in recent years.

What Does This Mean for Affordable Housing and Urban Development?

The budget has also allocated significant funds for the Pradhan Mantri Awas Yojana (PMAY), aiming to construct 30 million additional houses. This focus on affordable housing is expected to benefit the real estate sector, particularly in urban areas. Moreover, the government’s push for urban renewal and infrastructure development, including transit-oriented development and improved urban infrastructure, could lead to increased demand and investment in real estate.

FAQs

How will the new LTCG tax rate affect my property sale?

The new LTCG tax rate is 12.5%, but without the indexation benefit, your taxable gains may be higher, resulting in a potentially larger tax bill.

Is the removal of indexation benefit fair to long-term investors?

The removal of the indexation benefit simplifies the tax process but may increase the tax burden on long-term investments, which could be seen as unfavorable by some investors.

What are the benefits of the 2024 budget for real estate investors?

The benefits include a lower LTCG tax rate and increased government spending on affordable housing and urban infrastructure, which could stimulate the real estate market.

How does the 2024 budget impact affordable housing?

The budget’s significant investment in PMAY and urban development projects aims to boost the supply of affordable housing, which could be beneficial for both buyers and investors.

Will the changes in the 2024 budget affect property prices?

While the changes could influence market dynamics, the overall impact on property prices will depend on various factors, including market demand, economic conditions, and regional policies.

Should I sell my property now or wait?

Deciding when to sell depends on your financial situation, investment strategy, and how the new tax rules impact your specific case. Consulting with a financial advisor is recommended.

The 2024 Union Budget introduces significant changes for real estate investors, particularly with the new LTCG tax rate and the removal of the indexation benefit. While the lower tax rate may seem beneficial at first glance, the lack of inflation adjustment could increase the overall tax burden. However, the budget also offers opportunities, particularly through increased spending on affordable housing and urban infrastructure. Real estate investors will need to carefully evaluate these changes and consider how they fit into their broader investment strategies.